Running a small business brings with it a unique set of challenges—managing cash flow, keeping track of expenses, and ensuring timely payments are just a few of the daily hurdles. One of the costliest and time-consuming tasks for small business owners is managing accounting and invoicing. However, with the surge of cloud-based invoicing tools on the market today, companies can now save up to 50% on accounting costs by switching to automated invoicing solutions.

By streamlining your invoicing processes, reducing manual error, and improving cash flow with timely billing, these tools not only save you time but also money. Best of all, many of them are designed specifically with small business needs in mind, offering affordability, usability, and flexibility.

Contents

Why Traditional Accounting Methods Are Costly

Traditional accounting systems often include manual entries, spreadsheets, and reliance on part-time or full-time bookkeeping professionals. These methods are not only outdated, but they also carry a number of hidden costs, such as:

- Time-consuming data entry

- Higher likelihood of human error

- Expensive professional services

- Delayed payment cycles

When invoices are slow to go out, payments come in even slower, leading to disrupted cash flows. Furthermore, correcting errors or retrieving client records can waste hours of valuable time.

The Power of Invoicing Services for Small Businesses

Modern invoicing platforms are designed to simplify your billing process, track payments, and automatically generate reports. This not only reduces the need for hiring additional staff but also increases financial accuracy.

Here’s how switching to a top-tier invoicing service can substantially reduce your accounting costs:

- Automation: Send invoices automatically and set up recurring payments.

- Reduction in Human Error: Automated calculations ensure correctness every time.

- Time Savings: Generate invoices with a few clicks instead of manually writing them.

- Access to Real-Time Reports: Easily monitor cash flow and unpaid invoices.

Top Invoicing Services to Consider

There are dozens of invoicing tools on the market, but only a few truly stand out for their combination of features, pricing, and ease of use. Let’s explore some of the best invoicing services for small businesses that can help you cut your accounting costs in half.

1. FreshBooks

FreshBooks is a cloud-based invoicing and accounting tool tailored for small service-based businesses. It offers intuitive features like time tracking, expense management, and custom invoice creation.

- Automatic reminders and recurring invoices

- Integrated payment gateways

- Mobile-friendly interface

- Real-time accounting reports

FreshBooks also offers affordable monthly plans that make professional invoicing accessible without heavy investments.

2. QuickBooks Online

QuickBooks is a well-known name in the accounting world, offering powerful features for a range of business types. Its simplified invoicing tool allows you to customize templates, track payments, and sync with your bank account.

- Invoicing + Full Accounting Integration

- Smart tax tracking

- Great support and tutorials

It’s ideal for growing businesses looking for an all-in-one solution.

3. Zoho Invoice

Part of the Zoho suite of business tools, Zoho Invoice is trusted by freelancers and small teams globally. It offers everything from invoice customization to multi-currency and multilingual invoicing.

- Completely free for small businesses (as of latest offers)

- Detailed time-tracking and reporting tools

- Supports multiple payment methods

Its highly customizable dashboard makes financial management both easy and visual.

4. Wave

Wave is a standout solution for small businesses that need professional invoicing without the high cost. The best part? It’s free for most of its essential features including invoicing and accounting.

- No monthly fees for basic use

- Secure cloud storage

- Built-in payroll (at additional cost)

Wave is perfect for micro-businesses, freelancers, and solopreneurs looking to cut down on costs significantly.

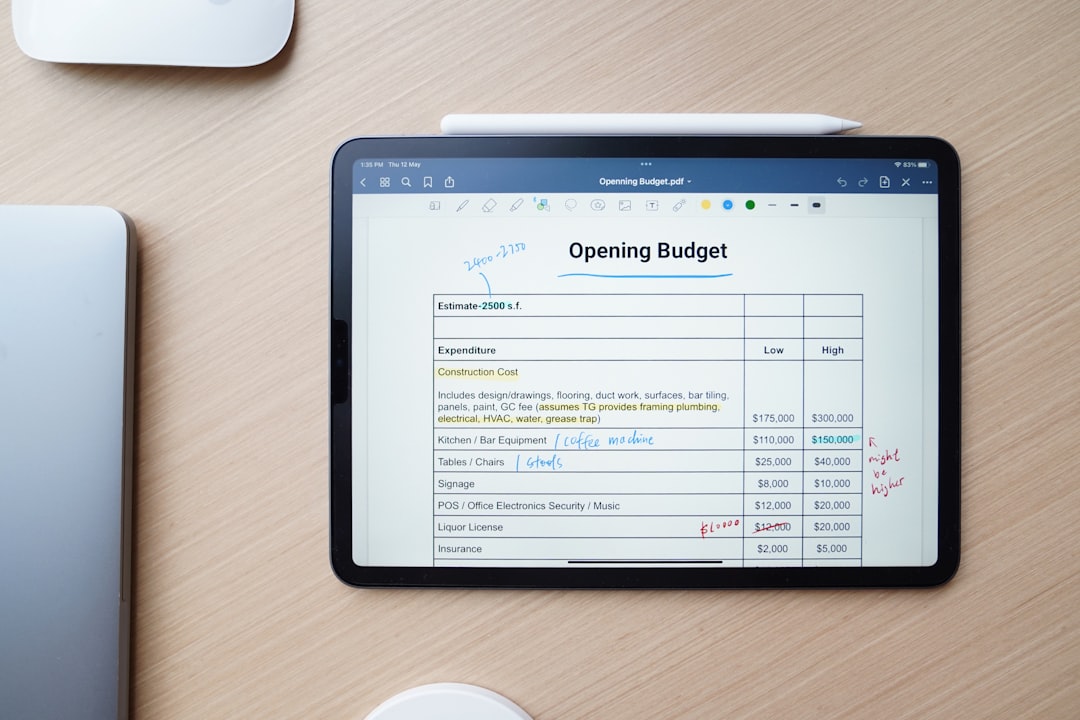

Real Cost Savings with Invoicing Automation

How do these tools lower overall accounting expenses? Consider this: hiring a part-time bookkeeper may cost your business between $20 to $50 per hour. In contrast, an all-in-one billing and invoicing software like FreshBooks or Wave could cost between $0 and $30 per month for basic plans.

Here’s how your savings can add up quickly:

- Eliminate or reduce outsourcing for invoicing

- Speed up client payments through automation

- Avoid costly late fees or lost revenue due to invoicing errors

Moreover, these platforms often sync with bank feeds and tax calculators, offering small business owners greater control with fewer headaches during tax season.

Features That Matter Most

When selecting an invoicing service, look for key features that support scalability, provide good ROI, and integrate seamlessly into your existing workflow.

These core features include:

- Custom Invoice Templates: Let your invoices reflect your brand.

- Mobile Access: Manage invoices on-the-go from your phone or tablet.

- Automated Follow-Ups: Send payment reminders automatically.

- Recurring Billing: Perfect for subscription services or regular clients.

- Multi-Currency Support: Do business globally with ease.

Tips for Making the Switch

Transitioning from manual invoicing to an automated system doesn’t have to be disruptive. Here are few tips to ensure a smooth changeover:

- Start with a trial version to test features

- Import data gradually or during a financial quarter reset

- Inform clients of changes in the billing format

- Train your team briefly on how to use the platform

Most invoicing providers offer excellent customer support and migration guides to assist you throughout the switch.

Conclusion: A Smart Investment in Financial Efficiency

Using a reliable invoicing service is not just a convenience—it’s a strategic move for your small business. By leveraging today’s technology, you can reduce accounting costs by as much as 50%, create more time for what you do best, and improve your overall financial health.

Whether you are a freelancer, consultant, or a growing business, automating your invoicing is a smart step toward increasing profitability and managing your cash flow like a pro. The right solution can empower your business to operate more efficiently, gain better client relationships, and make financially sound decisions.

So don’t wait until the end of the fiscal year. Explore the best invoicing tools today and take control of your business finances in a way that’s easy, affordable, and effective.